State Farm Auto Insurance In our opinion: With over 16 percent of the market and nearly 41 billion direct premiums written in 2019, State Farm is the clear leader in the industry. We have awarded the company Best for Student Drivers for its safe driving program and discounts for drivers under the age of 25. Industrial Position95 Affordability95 Coverage95 Affordability90 Customer Service95Online Experience100ProcessExcellent Financial Strength Classic & Vintage Car InsuranceLoyalty Discounts Most Value for Customers with Multiple Insurance Policies at FarmCons State Limited Web and App Features Problem Reporting for Individuals Who File a Claim Against Another Driver95

State Farm Auto Insurance In our opinion: With over 16 percent of the market and nearly 41 billion direct premiums written in 2019, State Farm is the clear leader in the industry. We have awarded the company Best for Student Drivers for its safe driving program and discounts for drivers under the age of 25. Industrial Position95 Affordability95 Coverage95 Affordability90 Customer Service95Online Experience100ProcessExcellent Financial Strength Classic & Vintage Car InsuranceLoyalty Discounts Most Value for Customers with Multiple Insurance Policies at FarmCons State Limited Web and App Features Problem Reporting for Individuals Who File a Claim Against Another Driver95

Judging by the number of direct insurance premiums written, Sovkhoz is the largest personal auto insurer in the country, but is it the best choice for you? In this article, we look at State Farm auto insurance reviews, policy options, discounts, costs, and more to help you make your decision.

Choosing the right insurer is key to protecting your finances after an accident. Along with State Farm, we have reviewed some of the best auto insurance companies on the market and ranked them based on their policy options, affordability, customer service, and other important factors. You can start getting free auto insurance quotes from the top companies in your area by entering your zip code into the tool below.

State Farm Overview

Founded in 1922, State Farm is the largest auto insurance company in the United States, according to the National Association of Insurance Commissioners (NAIC). In 2019 alone, State Farm paid out $40.9 billion in insurance premiums. This figure accounted for 16.1 percent of the market share. Since Sovkhoz is such a large insurer, it enjoys good financial stability. The company has been rated A++ by AM Best, indicating its superior ability to pay customer claims.

State Farm is available in 48 states except for Massachusetts and Rhode Island. While Sovkhoz has received more complaints from customers than the average insurer, this high number has a lot to do with the company's size. It's hard to insure as many drivers as State Farm without any customer complaints. According to the US Auto Insurance Satisfaction Survey SM , State Farm regularly outperformed the regional average.

We named Sovkhoz the best insurer for student drivers based on its wide discounts available to teens and students.

State farm auto insurance

The type of car you own can greatly affect the type of coverage you choose and the price you pay for your policy. We love that State Farm auto insurance can cover a wide range of vehicles, from a standard Toyota to a Porsche 911.

At the State Farm you can purchase:

- Standard accident insurance, comprehensive insurance and civil liability insurance

- Sports car insurance

- Collectible and classic car insurance

Standard car insurance

Customers looking for standard insurance policies will find the following options:

- Liability Insurance A: Liability policies cover property damage to someone else's car, home, or personal property after an accident you caused. It also covers the other party's injuries, medical expenses, and lost wages.

- Accident insurance . It applies to your own vehicle, whether it is new, temporarily replaced, or a vehicle not owned by anyone in your family. This insurance covers damage from any collision, up to the amount of your car.

- Comprehensive insurance A: With a comprehensive policy, you can get coverage up to the value of your vehicle for non-collision damage such as fire, civil disturbance and disorder, theft, vandalism, weather, etc., or hitting an animal.

- Insurance for uninsured motorists . You can opt for uninsured or underinsured motorist insurance to cover your vehicle and any possible injuries caused by a driver without insurance or with a policy that cannot adequately cover the damage.

- Medical benefits insurance . Regardless of who is at fault, medical benefits insurance will cover injuries to you, your passengers, and anyone else who may be injured in an accident. Insurance includes pedestrian injuries and funeral expenses.

- emergency road service : This service covers the cost of mechanical labor at the site of the breakdown, the work of a locksmith in case of loss, theft or lock of the key in the car, emergency fuel delivery, oil delivery, battery delivery. and replacement of flat tires.

- Sharing Insurance . This insurance covers you in three different situations: when your application is turned on and ready to rent, when you approach the rider, and when you transport him. Insurance may include property damage, liability, uninsured motorist, and car rental benefits.

- Car rental insurance . It covers the cost of rent up to a certain amount for those who do not have insurance coverage or have exceptionally high deductibles. If you're involved in a rental car accident, State Farm will cover your deductible up to $500. You can also choose travel coverage, which covers up to $500 for food, transportation, and lodging if you are more than 50 miles from home.

Sports and classic cars

Sports and classic car insurance can be very expensive. Sports cars tend to be fast, which is considered a potential risk, and classic cars are often expensive to repair due to the parts needed. State Farm works with customers to make sure they get a lower price for their policy and takes the necessary steps to qualify for specialized coverage. But if you drive these vehicles frequently, you may have trouble finding affordable coverage at State Farm. This is because rates increase based on usage, and classic cars are only eligible if they are primarily used for shows.

Sports car insurance can be more expensive, and it can be hard to find affordable coverage from State Farm.

The cost of car insurance at the state farm

Overall, JD Power ranks State Farm's affordability on par with competitors such as Allstate, Farmers, Liberty Mutual, and GEICO. We consider prices to be average, so if price is your main criteria, it's best to compare prices from different companies.

State Farm provides free direct quotes through the quote system on its website. In our experience, the pricing engine is fast, but it is quite simple and may use some advanced features such as price comparison tools and other personal calculators.

Discounts on car insurance at the state farm

Not all insurance companies reward their loyal customers with discounts and other savings benefits, but State Farm offers discounts for customers who stay with the company and buy in addition to a single driver policy. For this reason, State Farm vehicle insurance is a better option for customers who use State Farm for more than just vehicle coverage. Loyalty discounts include:

- Multiple cars : Save up to 20 percent on your insurance policy if your family has two or more cars insured.

- Multiple lines : Save up to 17 percent on your insurance policy if you also purchase homeowner, renter, condominium, or life insurance from State Farm.

Perhaps the biggest beneficiaries of state farm insurance are teenagers and safe drivers. The following discounts help young drivers, their parents and careful drivers save money:

- Anti-theft discount . Get a discount if your car has an alarm or other warning system.

- Driver training discount . Drivers under the age of 21 may receive a discount to attend an authorized driver training program.

- Good discount for driving . New State Farm customers can receive an additional discount if they do not violate traffic rules or have an accident for three years.

- Discount for students at school . Students under the age of 25 may qualify for a discount if they only use their car during the summer and public holidays.

- Discount on safe driving courses A: State Farm agents can provide a list of Defensive Driving Qualifications that count toward the Defensive Driving Discount.

- Vehicle Safety Discount . Save up to 40 percent on medical bills for vehicles manufactured after 1994. Today, a large number of vehicles are used on the roads.

- Discount for good students : Save up to 25% on your insurance policy to get good grades. This discount is valid even after graduation from college until the age of 25.

- Discount without incident A: Get a discount if you avoid a paid accident within three years. Your discount may increase over time if you continue to use State Farm auto insurance.

- Passive Retention Discount : Get up to 40 percent discount on health insurance for 1993 and older vehicles that have a factory-installed airbag or passive restraint system.

State Farm Claims Process

Claims for State Farm auto insurance can be filed online, through the mobile app, by calling the Claims Department (24/7), or by calling your local State Farm agent. After you file a claim, State Farm will review it and request additional information if necessary. The agent will send you an estimate and repair options.

State Farm pays for repairs in three ways: directly to the repair shop, directly to your bank account, or directly to your mailbox via check. It is very easy to use the mobile application to file a claim and manage a claim, pay a bill, or upload photos.

State Farm Auto Insurance Reviews

State Farm has almost 100 years of experience in insurance for drivers. The Better Business Bureau (BBB) awarded State Farm an A+ for positive business ethics and handling customer complaints. According to JD Power surveys, State Farm regularly achieves or exceeds the regional average in customer satisfaction.

Customers who use multiple State Farm services tend to speak highly of their experience. Take, for example, this review of State Farm auto insurance by a loyal customer on Trustpilot:

“[I] love state farm. All my insurance, banking and financial planning is done through [State Farm]. Fast service, both at the agent's office and over the phone. They needed towing, they sent someone as soon as possible, and they didn't pay [money] out of pocket for towing. [I] had a [account] verification question and they were available on the phone very late and could chat on [instant message]. I love my agent! » – Anonymous

And another customer:

"The state farm owns all my insurance business." — James E.

In our research, we found that customers had the most negative feedback on claims and repair times, customer service professionalism, and claims problems that were caused by another driver. These claims took longer on average, and customers did not always receive a prompt response from their representative or agent.

Here are two examples of negative reviews about State Farm auto insurance from Trustpilot:

“Sovkhoz was a very good deal many years ago. After an accident, prices skyrocket, even if you're not at fault. The agents are great, but it's so out of reach right now. I had to cancel the policy [and] switch to the progressive version." — Emma

“I asked Thursday afternoon for proof of payment and they hung up. However, I called again. Then they hung up - again. They are also incompetent - two different people couldn't spell my email address correctly." — Rhett W.

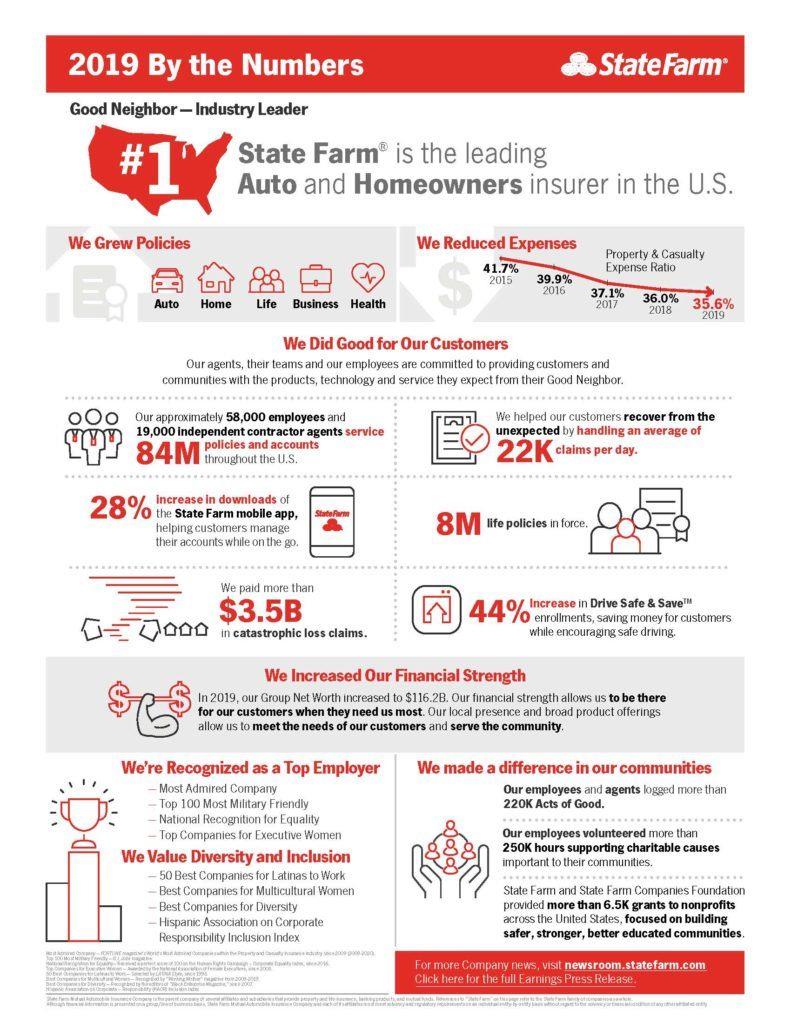

Infographic courtesy of State Farm.

Infographic courtesy of State Farm.

Applications and technologies

State Farm offers two mobile app-based programs that encourage good driving skills: Drive Safe & Save TM and Steer Clear ? .

Drive Safe & Save offers up to 30% discount on your insurance policy. Through the mobile app, good driving skills are tracked and rewarded. For example, State Farm rewards drivers who avoid hard acceleration, hard braking, fast cornering, speeding, and distracting driving.

Steer Clear is a safe driving program designed for young drivers. If your policy lists a driver under the age of 25, they may be eligible for this program. Through a series of courses, mentoring and driving hours, young drivers can earn program certification and policy discounts. Like Drive Safe & Save, this program also uses a mobile application to track driving behavior.

Conclusion: Best for student drivers

Based on our own research and State Farm auto insurance reviews, we believe State Farm's biggest asset is its student driver programs. State Farm also offers many forms of insurance, such as homeowner, apartment, renter, and life insurance, which many customers bundle with their auto insurance at the best price.

Availability, on the other hand, is not so high. Companies like GEICO offer the best experience in this area. Find out more about competitor policies in our ranking of the best auto insurance companies.

If you're looking for brand name insurance and you're also looking for other types of insurance, consider State Farm auto insurance for your vehicle.

Fill out the form to see what's available in your area and get a free quote.